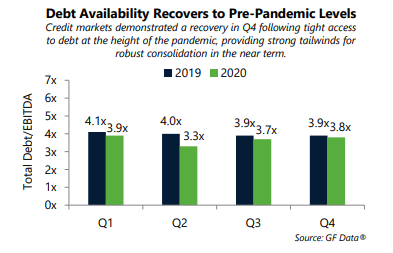

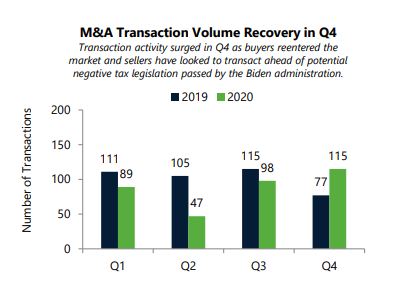

| Boston, MA, March 30, 2021 – Capstone Headwaters released its Construction Services Update today, reporting that optimism in the Construction Services industry has been supported by an improving backlog of projects and heightened confidence for near-term sales and employment. Following depressed levels at year end, the Commercial & Institutional and Infrastructure segments have experienced a healthy pipeline of projects, with backlog increasing in February to 8.3 months and 9.1 months, respectively, according to Associated Builders and Contractors (ABC). Demand visibility has improved substantially in Q1, evidenced by the Dodge Momentum Index, a monthly measure for nonresidential projects in planning, rising 7.1% in February from the prior month, marking the index’s highest reading in nearly three years. “2021 will be a perfect storm for the mergers and acquisitions industry and result in record setting levels of transactions. Baby boomer owners looking to exit will be taking advantage of their last opportunity to lock in low capital gains tax rates while acquirers will take advantage of record setting amounts of dry powder, low interest rates, and unprecedented levels of federal stimulus to generate continued growth,” commented Darin Good, Capstone Managing Director and lead contributor to the report. M&A activity in 2020 trailed prior year levels by 14.5% as Q2 experienced a drastic slowdown in transaction volume. However, volume surged in Q4 as buyers returned to the market with 115 transactions announced or completed, far outpacing the prior year quarter. As market turbulence has subsided, many deals previously placed on hold have resumed, lending to robust transaction markets. To access the full report, click here   ABOUT CAPSTONE HEADWATERS ABOUT CAPSTONE HEADWATERSCapstone Headwaters is one of the largest and most active independent investment banking firms in the United States. The firm has a rich, 20-year history of achieving extraordinary results for middle market entrepreneurs, business owners, investors, and creditors. Capstone offers a fully integrated suite of corporate finance services, including M&A, debt and equity placement, corporate restructuring, valuation and fairness opinions, financial advisory, and ESOP advisory services. Headquartered in Boston, the firm has 175+ professionals across 17 offices in the U.S., with an international presence including over 450 professionals in 40 countries. With 16 dedicated industry groups, the firm delivers sector-specific expertise through large, cross-functional teams on a global basis. For more information, visit www.capstoneheadwaters.com. For More Information Contact the Key Report Contributors: Darin Good Managing Director 303-549-5674 dgood@capstoneheadwaters.com Crista Gilmore Director 303-531-5013 cgilmore@capstoneheadwaters.com Brian Krehbiel Director 970-215-9572 bkrehbiel@capstoneheadwaters.com |

Capstone Headwaters Reports: Construction Services Demand, M&A Activity Improves